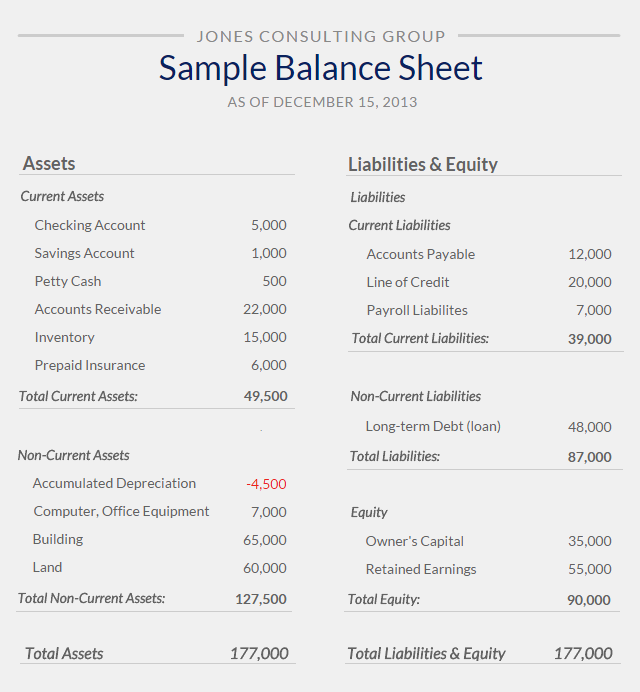

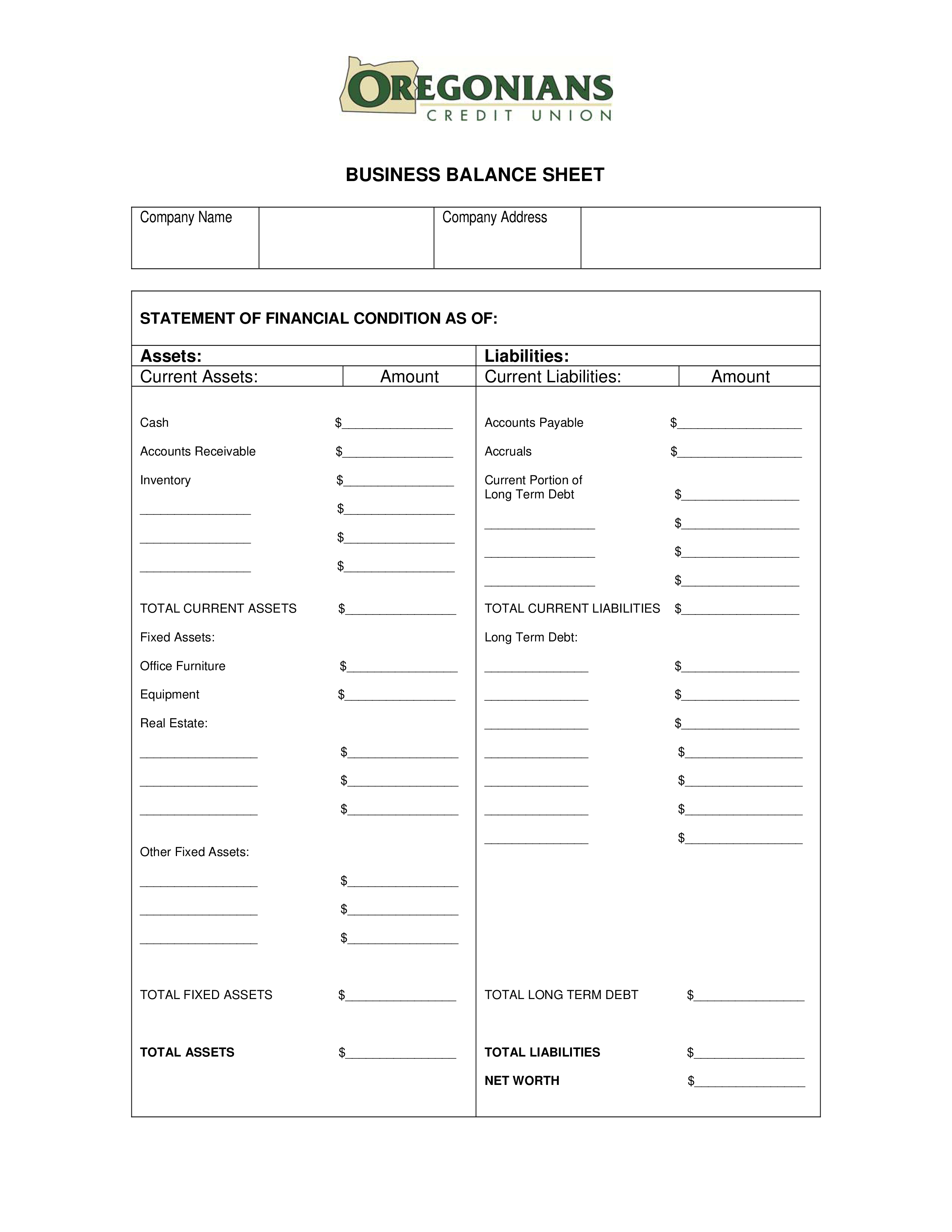

By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction. The balance sheet and the income statement are two of the three major financial Mar 27, · Projecting your balance sheet can be quite a complex accounting problem, but that does not mean you need to be a professional accountant to do it or to benefit from the exercise. The desired result is not a perfect forecast, but rather a thoughtful plan detailing what additional resources will be needed by the company, where they will be needed, and how they will be financed Sample Document THE BALANCE SHEET The Balance Sheet is a measure of the solvency of the business, and the degree of the owner’s investment which, in the last analysis, is the “cushion” that protects creditors. Illustrated below is a typical balance sheet format (applicable to any type of business). Name of Company Address To Balance Sheet As Of20File Size: 75KB

Example balance sheet | Small Business

Project Management Free Balance Sheet Template for Your Business. The question is: how do you avoid their fate? How can you predict and resolve financial issues before they collapse your business? Enter: the balance sheet. Balance sheet is essentially a business plan balance sheet sample statement that captures all assets and liabilities of an organization at a specific point in time.

Your balance sheet presents and helps you gain insight into:. Creating a comprehensive balance sheet can seem like a daunting task, but worry not! Below you will find all you need to understand:.

Among other things, this can be useful if you want to:. The template below comes with all essential financial ratios. Ideal to suit the needs of small business owners! Note that this is a View-only Google Sheets file. You cannot edit it directly. Now that you have the template to get you started… How do you fill it out?

And what exactly does the business plan balance sheet sample sheet show, anyway? These are items with a lifespan of less than a year and are easily convertible into cash. Current assets include:.

Fixed assets cannot bring in cash easily and are not disposed of within the accounting year. Long-term assets may include:. They are amounts that should be paid to creditors within a year using the current assets available. Current liabilities include:. This section shows what you own.

Here you have it: a summary of all the standard balance sheet elements. Ensuring your balance sheet is well done will help you to always know the financial position of your business. Consequently, it will be easier for you to make major decisions in an informed, rational way.

Feel that you needed one yesterday? Get started today with our hassle-free balance sheet template! IT entrepreneur, executive and a former engineer, business plan balance sheet sample. Big fan of playing tennis, snowboarding, traveling, reading books, and of course I live and breathe our product. Free Balance Sheet Template for Your Business Mike Kulakov, May 14, Table of Contents hide. What is the Purpose of a Balance Sheet? A Free Balance Sheet Template. What Does the Balance Sheet Show 1.

Current assets. Fixed long-term assets. Current liabilities. Long-term liabilities. Frequently Asked Questions. The Bottom Line. Track time right where work happens. Estimate tasks, set budgets, keep time and customize reports — all inside your project management tool. Get it now. Mike Kulakov IT entrepreneur, executive and a former engineer, business plan balance sheet sample.

BALANCE SHEET explained

, time: 9:10Professional Balance Sheet Template for Your Business (FREE)

Jul 17, · Our Sample Balance sheet shows at the end of the year Retained Earnings of $21,, the same as the Net Operating Income. If the business earned the same amount next year and the funds were not paid out as taxes or dividends (or otherwise distributed), the Retained Earnings would be $43,, or double the first year’s blogger.comted Reading Time: 7 mins By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports. Every time a company records a sale or an expense for bookkeeping purposes, both the balance sheet and the income statement are affected by the transaction. The balance sheet and the income statement are two of the three major financial Business premises $ , Vehicles $ 70, Total Non-Current Assets $ , TOTAL ASSETS $ , Current Liabilities Accounts payable $ 25, Bank overdraft $ 10, Credit card debt $

No comments:

Post a Comment